spread betting vs cfd trading|cfd vs spread betting uk : Clark A key difference between spread betting and CFD trading is the taxation of profits. Gains from spread betting are tax-free*, while profits made from CFD trading are .

El Presidente: Explores the real-life conspiracy underlying the beginning of the 2015 FIFA Gate corruption scandal. The series covers how this house of cards fell apart because of Sergio Jadue, unknown B-league Chilean soccer club president. Jadue becomes president of the Chilean National Soccer Association, brings Copa America to .Wagering requirements: 25x (bonus + deposit) (restrictions apply) Some types of games have a decreased contribution towards the wagering requirements: Slots 100%, Table games 20%, Video poker 10%, Roulette 5%, Blackjack 5%, Baccarat 5%, Live games 0%, Craps and dice 0%. You will have to wager 25-times the sum of your bonus and .

spread betting vs cfd trading,Spread bets have fixed expiration dates when the bet is placed, while CFD contracts have none. Likewise, spread betting is done over the counter (OTC) through a broker, while CFD trades can be completed directly within the market. Direct market accessavoids some market pitfalls by . Tingnan ang higit paPopular in the United Kingdom, contracts for difference (CFDs) and spread betting are leveraged products fundamental to the equity, forex, and index markets. Leveragedproducts . Tingnan ang higit pa

Contracts for difference, or CFDs, are derivative contracts between investors and financial institutions in which investors take a position on the future value of an asset. Differences . Tingnan ang higit pa

CDFs and spread bets are leveraged products whose values derive from an underlying asset. In these trades, the investor has no ownership of assets in the underlying . Tingnan ang higit paSpread betting, also known as financial spread betting or FSB, allows investors to speculate on the price movement of a wide variety of financial instruments. In other words, an investor makes a bet based on whether . Tingnan ang higit pa

cfd vs spread betting uk A key difference between spread betting and CFD trading is the taxation of profits. Gains from spread betting are tax-free*, while profits made from CFD trading are . What is Similar Between Spread Betting and CFD Trading. Some of the main similarities between spread betting vs CFD trading .The key difference between spread betting and CFD trading is how they are taxed. Spread bets are free from capital gains tax, while profits from CFDs can be offset against losses for tax purposes. You don't pay .Spread betting and CFD (Contract for Difference) trading represent two prominent strategies in the realm of financial derivatives. These methods provide investors the .

CFDs offer higher leverage but come with greater risk exposure; spread betting offers lower leverage but is tax-free in the US. Consider trading costs, product range, tax .

spread betting vs cfd trading cfd vs spread betting uk 9 min. The ultimate face-off: Spread betting vs CFDs. Understanding the nuances between spread betting and CFD trading is essential for any trader. These . The main difference between spread betting and CFD trading is how they are treated for Capital Gains Tax (CGT). Spread betting is free from Capital Gains Tax .

Spread Betting is a derivative strategy where traders bet on the direction of price movements of an asset. Like CFDs, traders do not own the underlying asset. .

Get started. Spread betting and CFD trading are leveraged trading products that offer many of the same benefits. They're similar in that they're both margined products. This .CFDs and spread betting are both examples of leveraged products that provide large market exposure for a small initial deposit. Learn which trading method suits your investment style

The key difference between spread betting and CFD trading is how they are treated for taxation. Spread betting is free from capital gains tax (CGT) while CFD trading requires you to pay CGT*. Spread betting is also .

Spread betting is a form of speculative trading where individuals can speculate on the price movements of various financial instruments, such as stocks, indices, currencies, and commodities. It involves making predictions on whether the price of an asset will rise or fall. Unlike traditional investing, spread betting allows traders to profit .spread betting vs cfd trading Our charges: With spread betting, the cost is mainly in the spread – the difference between the buy and sell price. CFD trading, on the other hand, might include commissions or financing charges, depending on the broker. Other charges: Both spread betting and CFDs may incur additional costs like overnight funding charges.

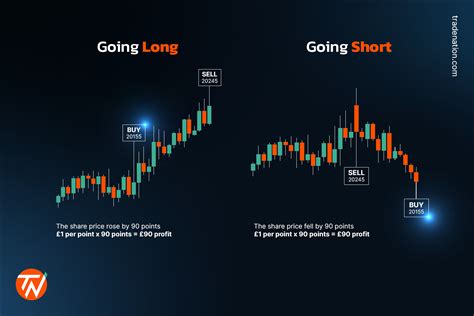

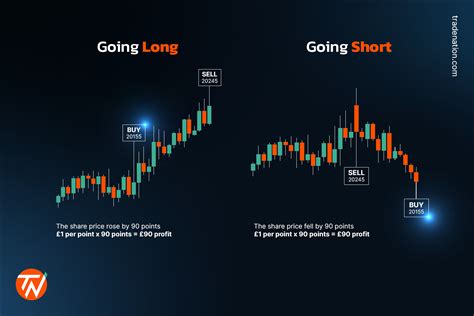

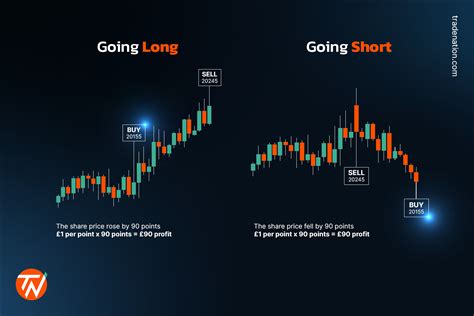

Spread betting vs CFDs trading – Common points. Whether in spread betting or with CFDs, both instruments allow you to place bullish or bearish bets (short selling) on a wide range of asset classes, without ever holding the underlying assets. It is thus possible to play on the asset price movements of shares on the stock market .

Speculative Trading: Both spread betting and CFD trading are speculative trading methods that allow traders to speculate on the price movements of various financial instruments without owning the underlying assets. Leveraged Trading: Both spread betting and CFD trading involve the use of leverage. This means traders can control larger .Where CFDs are Taxing. Both spread betting and contracts for difference don’t incur stamp duty. However, CFDs are liable to capital gains tax at the investor’s marginal tax rate after the annual allowance has been surpassed (currently at £10,100 in the UK), while gains from spread bets are gloriously tax-free.

CFDs are priced just like the underlying assets you are trading, so forex CFDs are quoted in the same pricing structure (1.0500), while spread betting may be displayed as 10500. These are the same prices, but the spread betting price is displayed in points vs actual price to help see price-per-point movements.Trading CFDs closely resembles spread betting, but there are some key differences. Spread bets are made in an amount of money per point, CFDs are traded in standardised contracts. Profits made from spread betting are currently free from capital gains tax, but CFDs are liable. Spread bets generally expire at a fixed time if you don't close them .Spread betting and CFD trading are similar in that both involve speculating on the price movements of financial instruments, but the key difference lies in how profits and losses are taxed. Spread betting is often tax-free in many jurisdictions, while CFD trading may be subject to capital gains tax. This article provides a comprehensive comparison of CFDs and Spread Betting for online trading. It discusses differences in tax treatment, market access, costs, trade sizing, and regulation. The summary emphasizes the importance of considering tax implications, investment goals, risk tolerance, market interest, costs, regulatory . The costs of trading CFDs include a commission (in some cases), a financing cost (in certain situations), and the spread—the difference between the bid price (purchase price) and the offer price .The differences between Spread Betting and CFD trading, and the advantages of each when trading with FxPro, are covered in more detail in the table below: Forex, Spot Indices, Spot Metals and Spot Energy. 1 Tax laws are subject to change and depend on individual circumstances. 2 Subject to the FxPro Order Execution Policy.

An explanation of spread betting. Financial spread betting is a ‘bet’ on the outcome of a product either moving in the direction of your trade resulting in a win or, moving in the direction against your trade resulting in a loss. The ‘spread’ is the difference between the Buy and Sell price. Unlike a fixed-odd bet that has a win or lose . Spread Betting Vs CFD Trading. Spread betting and contracts for difference (CFDs) are both forms of derivative trading, but they have some key differences: Market Access. Spread betting typically offers access to a wide range of financial markets, including stocks, indices, currencies, commodities, and more.71% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.Spread betting is a popular alternative to traditional buy-and-hold investing. Discover the main differences between spread betting and share dealing, and which method is right for you. Start trading today. Call 0800 195 3100 or email [email protected]. We’re available from 8am to 6pm (UK time), Monday to Friday. a. Spread betting. b.The spread is the difference between the bid and ask prices, and varies depending on market conditions. In most cases we charge our own spread on top of the market spread, as our fee for the trade. Spread charges apply to CFD trades for all markets except shares. For every shares CFD trade, you’ll pay a commission instead of a spread.

spread betting vs cfd trading|cfd vs spread betting uk

PH0 · contract for difference investopedia

PH1 · cfd vs spread betting uk

PH2 · Iba pa